Private Credit 2.0 Is Here

The private credit market is booming — and evolving toward greater sophistication and opportunity for institutional allocators. Managers specializing in the differentiated private credit segments look forward to a bright future as their focus broadens beyond middle-market direct lending.

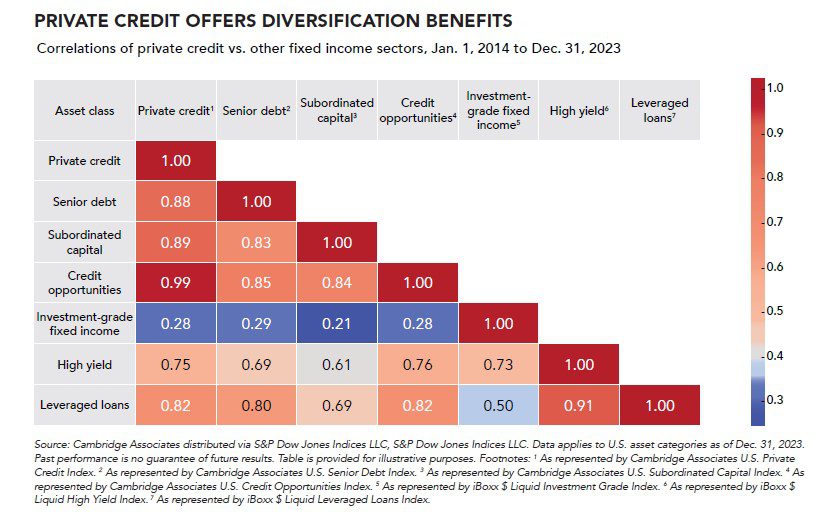

Much about the market has changed in the past decade, according to David Mihalick, co-head of global investments at Barings. “Over the last 10 years, a lot of institutions have allocated to direct-lending strategies to enhance or replace some of their liquid high-yield or below-investment-grade credit allocations,” he said. As more investors have become comfortable with having some or an increasing portion of their overall portfolio in private assets, they’re looking at other parts of their portfolio that direct lending hasn’t yet replaced, he added. Many appreciate that private credit is an attractive path to diversification that trades some liquidity for a higher return with manageable risk.

Nik Singhal, managing director and group head of direct lending at ORIX USA, sees the institutional world as more familiar with, and knowledgeable about, what private credit can deliver for portfolios. The asset class has naturally evolved beyond the upper and core middle-market tiers, which have historically been the biggest beneficiaries of capital flows.

“Perhaps the most common market expansion has been into lending to the lower middle market and to companies that need growth capital or venture funding, which are more specialized areas,” Singhal said. “A couple of newer and developing areas with-in private credit are asset-based lending and fund finance. Many investors or allocators would be well served to focus on them and seek out managers with the right skill set and track record.”

Thank the Banks

Some of private credit’s growth is due to the retreat of public lenders — particularly banks — from market segments they once dominated. A variety of circumstances have compelled many banks to tighten their balance sheets by reducing loan exposure.

Richard LaBelle, senior associate, private markets, at S&P Dow Jones Indices, noted that private lenders have been able to step into the banking vacuum by providing flexible financing solutions and borrower-specific loan structures. This flexibility can include customized repayment schedules, covenant protections and the ability to underwrite more complex or unconventional deals.

Labelle also pointed to ways in which private lenders and banks are now collaborating in the new era of private credit. “There are opportunities for banks to originate loans and then syndicate or sell portions to private credit funds. Banks thus can manage their risk exposure while still being able to service their clients’ needs,” he said. “In addition, banks can partner with private credit firms to co-lend on larger transactions. This combines the capital, resources and expertise that each party brings to the table.”

ORIX USA’s Singhal expects banks to collaborate with private lenders in other ways. “Instead of being the lender, banks are pivoting to provide leverage facilities to private credit funds that run leveraged strategies, in addition to creating origination partnerships with direct lenders,” he said. “Even though their capital needs might be changing, they still want to reap the benefits of their origination networks by working with private credit shops.”

Proved Under Stress

Some say that private credit’s future is unclear because, among other things, it hasn’t proved itself in a period of high market stress. Not so, according to Singhal.

“The last two years have been a significant stress test, bigger than the 2008 financial crisis. There were important reasons why they were so stressful,” he said. “Interest rates unexpectedly went up a lot and fast, which put severe strain on companies’ ability to service their debt. Inflation rose to its highest level in decades, which pushed the cost of goods up and profit margins down. Private credit defied expectations and held up well, as it should have.”

Structural Shift

Barings’ Mihalick sees plenty of room for growth across private markets going forward. “We’re having more conversations around private investment-grade credit and asset-backed finance. Infrastructure debt continues to be an area of interest, particularly given the structural tailwinds supporting that market,” he said. “Real estate debt is playing a growing role in investors’ portfolios as well, as it can serve as an effective diversifier from more corporate-oriented opportunities.”

Many investors and managers share this optimistic view, which is supported by industry estimates. Preqin, the alter-native investments data provider, forecasts that the market will grow from $1.7 trillion currently to $2.6 trillion in 2029. In addition, private equity firms have a massive amount of uncommitted capital for credit-based deals: Based on data compiled by Preqin and S&P Global Market Intelligence, this dry powder totaled approximately $385.3 billion at year-end 2024.

In Search of Alpha

In Search of Alpha

Significant factors are driving institutions’ rising allocations to private credit: Its opportunity set is expanding, it’s available at a greater scale, and it offers key benefits for institutional portfolios. The latter notably include potentially higher returns than public assets, as well as diversification, lower volatility and lender-friendly protections.

Where might private credit investors find alpha in the current environment?

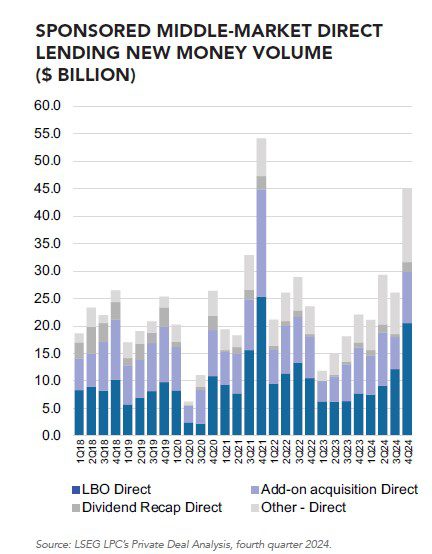

The lower middle market remains an appealing destination. Barings’ Mihalick pointed out that this area thrived in 2024, even as PE-backed mergers and acquisitions activity — the top source of lower middle-market lending — didn’t rise as much as many dealmakers expected.

Last year was Barings’ second-most-active year for direct lending. “We saw significant deal flow from our existing portfolio, as sponsors used the muted environment as an opportunity to do add-on acquisitions,” Mihalick said. “Though higher interest rates dampened enthusiasm for deals, sponsors generated value by doing add-ons to grow earnings, create operational synergies and build out their platforms.”

Attractive Subsectors

ORIX USA concentrates on subsectors where it historically has found alpha or expects to generate it going forward. Some of these are lower middle-market lending, growth capital, fund financing and asset-based lending.

“We tend to focus on areas that are relatively uncrowded,” said Singhal. “The upper- and core-middle-market tiers, for example, are crowded with many, often undifferentiated, managers. We try to find spaces that are more specialized, where there’s enough room for us to carve out our own market niche.”

Lower middle-market lending is the largest of these sub-sectors for ORIX USA. The firm’s subsidiary, NXT Capital, which invests exclusively in this area, makes fi rst-lien, senior secured loans to PE sponsor-backed companies. Targeted borrowers have EBITDA in the $5 million to $50 million range, with a median of around $26 million to $27 million.

ORIX USA’s growth capital business lends to companies that are growing rapidly and may or may not be profitable. These companies are usually in the technology sector, often software companies that specialize in specific industries. Their balance sheets tend to be conservative, and they typically have recurring revenues between $10 million and $200 million. ORIX USA has deployed its own capital in this segment for 20 years, has a strong track record and recently has begun to invest third-party capital, Singhal said.

Fund financing and asset-based finance are relatively new business lines for ORIX USA, which sees them as having highly attractive long-term potential. Fund financing concentrates on three types of loans to PE general partners: subscription facilities that lend to a GP’s fund secured by the fund investors’ capital commitments; credit lines based on net asset value that are secured by the cash flows and distributions from a fund’s underlying investments; and lending secured by the cash flows of the GP management company.

Singhal also believes that banks’ retrenchment from some lending lines is creating room for private credit to take a bigger role in asset-based finance. “We focus on off-the-run opportunities in asset-backed finance,” he said. “It could be receivables or core-plus infrastructure, such as data centers or fiber assets, etc. These are less mainstream but are available in size and becoming more common. Once we get the opportunity to dig in and do our work, we can get comfortable with the collateral and aim to generate returns in the high-single or low-double digits.”

Real Estate Beckons

Real estate isn’t top of mind for many private credit investors these days, as rising rates and a bust in office properties have deterred many investors from the asset class. Barings’ Mihalick takes a different view.

“We’re seeing a lot of interest and momentum in real estate debt. If someone’s been in the middle-market direct lending space for a while, they may decide they have enough exposure to corporate credit, but still want access to credit in general, via a fixed income-like opportunity. Real estate debt meets that need now,” he said.

It’s important for allocators to understand that real estate comprises much more than the office market, Mihalick added. It has multiple subsectors with different fundamental drivers. For instance, the shortage of housing globally suggests upside for residential development, and demand is rising for logistics assets, such as warehouses and data centers.

As for office properties, Mihalick believes that the worst could be over. Offices experienced a double whammy: higher rates, which made financing more expensive and pushed valuations downward; and COVID, which forced a secular decline in occupancy levels. “Higher rates have caused office valuations to reset to be more realistic given market conditions,” he said. “We’re seeing valuations bottom and stabilize. Overall, we are very bullish on the opportunities in real estate over the next several years.”

Correcting Misconceptions

Given private credit’s relative youth as an asset class, it’s not surprising that some investors have misconceptions about it. ORIX USA’s Singhal cited lower middle-market lending as a prime example.

It’s common for investors to assume that lending to the lower middle market is riskier than lending to the core and upper middle-market tiers, he noted. The lower tier, after all, is more fragmented, its borrowers and loans are smaller, and it requires specialized managers with deal origination pipelines that are hard to duplicate. By contrast, the core and upper tiers have larger borrowers, meaning that loans tend to be bigger and syndicated among many lenders.

But all isn’t as it may seem on the surface, according to Singhal. “In the lower tier, there are usually one or two lenders per deal, so lenders can work directly with borrowers instead of ceding negotiation and communication to a lead lender,” he said. “Lower-tier loans also tend to have strong lender protections in the form of tight covenants, while most core and upper-tier loans often have few or no covenants.”

Singhal added that lower-tier lenders have much more control over their investments and are better able to protect them. This is because financial reporting is more frequent — monthly instead of quarterly — and many lower-tier lenders manage their borrowers’ revolving lines of credit. As a result, lenders can see how and when borrowers are drawing down their revolvers and, if necessary, negotiate stronger protections.

ORIX USA’s experience in the lower middle market offers additional evidence that lower-tier lending isn’t necessarily riskier: As managed by its NXT Capital subsidiary, the historical loss rates of ORIX USA’s lower-tier strategy are comparable to, and often lower than, those in the core and upper tiers.

Weighing Liquidity

Illiquidity is a top concern among allocators considering a position in private credit, yet it also can be viewed positively. On one hand, it’s a problem if investors need to raise cash in a hurry, and on the other, it benefits investors in the form of premium yields and reduced portfolio volatility.

Barings’ Mihalick sees a developing misconception about private credit liquidity. The growth of private markets has prompted many originators and managers to create more liquidity in private assets — however, this may lead investors to overestimate how much liquidity there really is, particularly in challenging markets.

“We increasingly hear managers talking about providing liquidity in private markets, with some banks and managers setting up trading desks for certain private asset classes. But it’s important to understand that private market liquidity is not necessarily comparable to public market liquidity,” he said. “Often these desks trade only the names they’ve underwritten, and investors shouldn’t assume that this will create the degree of liquidity they would need during a period of market stress.”

How Can Managers Stand Out?

How Can Managers Stand Out?

What characteristics should institutional allocators look for when evaluating private credit managers? For Mihalick at Barings, it starts with the loan origination process, which connects borrowers with the capital they need. “Origination is a clear competitive differentiator,” he said.

In the direct lending space, origination relies heavily on relationships with the PE firms that sponsor M&A transactions. Experienced direct lenders typically have well-defined processes based on longstanding relationships with multiple sponsors.

As the private credit 2.0 opportunity evolves, there are many other origination channels to which managers must have access, Mihalick explained. These include, among others, partnering with peer asset managers and banks as well as working directly with companies that need capital. Doing so requires thinking like a solutions provider and being able to creatively deal with the complexities that come with many collateral types and risk profiles.

Importance of Scale

In addition to strong origination capabilities, Mihalick be-lieves that private credit managers must have scale to success-fully compete. For certain managers, reaching that next level can mean merging with, or being acquired by, another fi rm. M&A among managers has increased accordingly and is likely to continue.

The need for scale is driven not just by firms that want to sell, but also by institutional investors and potential acquirers. “For smaller, less-established managers, achieving scale frequently means combining with a bigger institution. For bigger institutions that want to break into one of the newer private credit subsectors, it’s often a question of whether to build or buy,” Mihalick said.

Smaller firms can hit an expansion wall and need more resources to keep growing, he continued. “If they specialize in a particular subsector, they become very attractive acquisition candidates for acquirers that are strong in other subsectors and want to enter the smaller firm’s market. We expect this trend to continue.”

Scale also benefits institutions that want to do more with fewer managers. “Instead of having 100 managers doing 100 things, [institutional investors] want 20 managers to do the same 100 things. That gives them scale in terms of their ability to oversee and monitor their managers and build more strategic solutions-oriented relationships,” he said.

Skin in the Game

Another desirable characteristic for private credit managers is investing their own capital alongside that of their clients. Having skin in the game, said ORIX USA’s Singhal, helps man-agers to stand out from the competition.

He noted that investing in-house money, which ORIX USA has done for many years, gives managers a unique perspective. “If we don’t do well, it’s really going to hurt us,” he said. “Having your actual dollars in the game is a completely different level of pain versus the risk of not earning incentive fees if performance is poor. There are not many managers who are willing to do it.”

ORIX USA uses its balance sheet to align with its clients’ interests in an additional way. As Singhal put it, “We’ve used our own capital to launch some funds and seed them. For clients, this kickstarts the deployment of their cash into the funds and mitigates the J-curve effect. Putting our balance sheet to work via seeding is designed to create a better return experience for our clients.”