By Thomas Paramore and Emily Greenwalt, Boston Financial

The shortage of quality affordable housing is a pervasive issue across the United States, and preserving existing affordable rental units is top of mind for many seeking a solution to the housing crisis. Investing in affordable housing addresses an important social need while delivering compelling investment benefits. In our opinion, preservation investments offer attractive, risk-adjusted returns as an asset class that can perform well under most market conditions — from periods of growth to economic downturns. Affordable housing preservation is a strong avenue for impact investing, as stable and affordable housing is linked to positive outcomes in health, education, and economic growth.

Affordable Housing and Preservation Defined

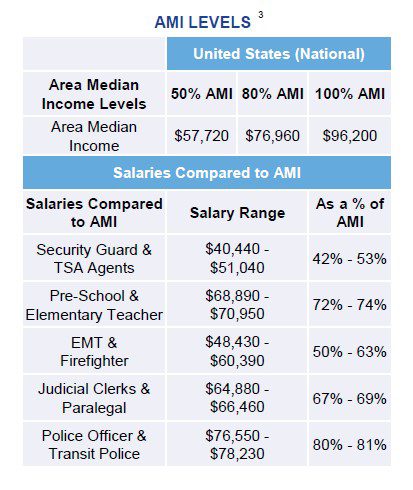

Boston Financial has been solely focused on the affordable housing market for over 55 years. In this time, we have seen real estate market cycles, regulatory and tax changes, and evolving definitions and perceptions of affordable housing. Affordable multifamily housing is currently defined as housing for renters who earn less than 80% of their local area median income (AMI). There are further distinctions for extremely low income (30% of AMI or income below federal poverty guidelines), very low income (30% – 50% of AMI), and low income (51% – 80% of AMI) populations. The reality behind the statistics is that salaries for many professionals are below the area median income. Across the country, our critical workforce such as nurses, firefighters, and teachers struggle to find quality, affordable housing in the communities where they work.

Affordable housing preservation involves investments in existing affordable rental homes that otherwise may be converted to market-rate housing or experience significant rent increases, displacing current residents. Properties may be naturally occurring affordable housing that are currently rented below market or those with formal affordability restrictions that are nearing the end of their compliance periods. Preservation can take many forms: an investment may stipulate limited rental increases on current tenants and implement modest rent increases upon unit turnover or may place long-term affordability restrictions on a property’s units. Preservation investment strategy requires a deep understanding of traditional real estate underwriting as well as an ability to navigate affordability statutes and is almost always a joint effort with the local municipality and other stakeholders.

Low Supply, High Demand

Several factors have contributed to the lack of sufficient affordable housing in the U.S, notably the recent pandemic and expiration of pandemic-related rent subsidies; rising inflation; significant local obstacles and higher interest rates preventing the construction of new multifamily housing units; and less available financial support from state and local governments.

The shortage of affordable housing is most acute for extremely low income (ELI) households, accounting for 11 million households, or about 25%, of the nation’s 45.1 million renters.1 Based on the standard definition of affordability that households should spend no more than 30% of their income on housing, there are only 7.1 million units available for ELI households, leaving a shortage of 3.9 million units.2 Across all 50 states, the shortage of affordable rental units continues to rise.

In the next five years alone, 342,809 units are scheduled to lose all rent and income restrictions as properties reach the end of their federally mandated affordability periods.4 Compounding the crisis, homeownership is increasingly out of reach across urban and rural areas alike. Home prices have skyrocketed 54% since 2019, and potential homeowners struggle in the face of high interest rates and low inventory.5 As it takes an increasingly large, and often untenable, percentage of income to afford homeownership, it is critical to maintain the country’s supply of affordable rental housing.

Preservation – Why Now?

The investment case for preservation is compelling in today’s market. Demand for affordable housing far outstrips supply, and demand often increases in recessionary environments as incomes fall and renters find themselves priced out of higher-class, market rate housing. As the U.S. continues to face economic headwinds, we believe preservation investing is poised to perform well relative to the traditional commercial real estate asset classes, while also generating positive social impact, for the following reasons:

Low start-up risk. Affordable housing preservation, by its nature, does not involve new construction and its associated risks. Existing, stabilized properties experience minimal construction and lease-up risk.

Reliable, durable income stream. Affordable multifamily properties targeted for preservation are typically classified as Class B, which have consistently outperformed Class A properties on a total return basis over the past decade.6 This is due in large part to occupancy rates at affordable properties, which remained higher and less volatile than their market rate counterparts during the past three economic downturns. An additional benefit to affordable housing is government-secured rent subsidies such as Section 8, which may support some or all units at affordable properties. In these cases, the government pays the rent for subsidized units directly to the property owner, eliminating the collection risk that can be found in conventional market-rate apartments.

Real estate diversifier and inflation hedge. Affordable housing provides important diversification within a broader real estate portfolio. In contrast to most other real estate sectors, demand for affordable housing can rise with inflation, which reduces renters’ buying power and forces some to seek lower-rent apartments. Affordable housing’s inflation-hedging and recession-resilient qualities help to offset corresponding weakness in other real estate sectors.

High barriers to entry. The affordable housing market presents significant barriers to entry. These include complex federal and local regulatory hurdles and the need for strong relationships with local stakeholders, government agencies, and others, which are developed over extended periods of time. Such barriers create challenges to new supply and underscore the importance of working with experienced managers who know the market and the major players involved.

Making an Impact

Beyond its financial benefits, affordable housing preservation is appealing for capital allocators who seek to invest for impact. These investors review opportunities more holistically and assess the value of their holdings not simply in financial terms, but also for the contributions they can make to the communities where investments are located. Studies indicate that housing security is a major determinant in health outcomes, economic opportunity, and educational attainment for members of a community.

According to research conducted by the U.S. Department of Housing and Urban Development, housing security positively affects physical and mental health.7

- “Lack of affordable housing can force households to make difficult sacrifices to pay rent, such as forgoing medicines, medical appointments, and healthier food options.”

- Housing stability reduces exposure to domestic violence, depression, food insecurity, and avoids overcrowded living conditions.

- Positive impact on well-being of children, including a reduction of behavioral problems.

Access to affordable housing can have a direct impact on economic mobility — the American Dream.

- Cost-burdened households spend a higher share of income on housing, leaving less to spend on other necessities, including food, childcare, and transportation.

- 43% of those born into the lowest 20% of income distribution (the bottom quintile) in the U.S. remain in that quintile their entire lives. Securing stable, affordable, and well-located housing offers low-income households a chance to concentrate time and resources on opportunities that can increase economic mobility, such as employment and education.8

Affordable housing has a positive impact on children’s development and educational opportunities:

- Researchers studied the impact of affordable housing on children’s cognitive development and found that when families were severely housing cost-burdened and spent more than half of their income on housing, their children’s reading and math abilities tended to suffer.

- When families can limit housing costs to 30% of their income, they tend to increase spending on their children’s development and education.9

These are just some of the tangible social benefits that affordable housing preservation provides underserved communities and families. These benefits are amplified with property-level resources, which can make a meaningful difference not only in the lives of residents but also in the financial performance of the property. Services such as financial literacy advisory, hands-on case management, educational initiatives, and healthy lifestyle programming have been shown to reduce resident turnover, nonpayment of rent, vacancy losses, legal fees, and bad debts.10

Investing and Choosing the Right Fund Manager

Investing in affordable housing preservation through a fund offers a streamlined means to review quality opportunities, optimize portfolio diversification, and ensure effective oversight for the life of the investment. In our opinion, affordable housing preservation is a highly specialized asset class that requires an equally specialized investment manager with the following characteristics:

A long track record. Manager experience is crucial. Affordable housing is so complex that it takes years to fully understand the regulatory landscape, overcome the high barriers to entry, and develop the relationships needed for success. Ideally, a manager will have been in the business for several decades.

Expert property evaluation. In addition to evaluating strong opportunities, knowing what not to buy and when not to buy can also have a positive impact on performance. The best managers have the expertise and pipeline depth to evaluate affordable housing properties critically and make sound investment decisions accordingly.

Strict underwriting policies and procedures. Investors must feel confident that the property underwriting adheres to strict policies and procedures. Maintaining discipline in the underwriting process is crucial to risk management and financial performance.

Established relationships. Managers must have established, close relationships with the key parties involved in affordable housing: developers, owner-operators, property managers, federal and local regulators, community leaders, and investors. They must be particularly diligent when choosing local operating partners.

Successful achievement of impact goals. Managers are best positioned to deliver on their impact goals if they create analytical tools to assess an investment’s impact. Managers should identify measurable impact targets; regularly track, review, and report on the metrics’ achievement; be accountable for performance; and communicate transparently with investors.

Strong risk-adjusted returns. Having a track record of historically strong risk-adjusted performance is crucial for managers.

In Summary

We believe affordable housing preservation can be an excellent core portfolio holding for consideration by a wide range of institutional investors. It fits especially well within a real estate allocation or to fulfill a commitment to impact investing and, with the right manager, can be an asset class that consistently performs in changing market conditions. What better way to be part of the solution to the nationwide need to preserve our existing affordable housing and achieve solid, risk-adjusted returns at the same time. The time is now.

About Boston Financial

Focused exclusively on affordable housing since its founding in 1969, Boston Financial is the largest Low Income Housing Tax Credits (“LIHTC”) syndicator in the country, managing a $16.2 billion portfolio comprising almost 1,900 properties. Boston Financial was acquired by ORIX Corporation USA in 2016 and is a purpose-driven company with over 200 team members. Boston Financial’s vision is to create a future where everyone has a home, one investment at a time.

About ORIX Corporation USA

Established in the U.S. in 1981, ORIX USA has grown organically and through acquisition into the investment and asset management firm we are today.

With a specialization in private credit, real estate, and private equity solutions for middle-market focused borrowers and investors, we combine our robust balance sheet with funds from third-party investors, providing a strong alignment of interest. ORIX USA and its subsidiaries — ORIX Advisers, ORIX Capital Partners, Signal Peak Capital Management, Boston Financial, Lument, Real Estate Capital and NXT Capital— have approximately 1300 employees across the U.S. and have $85 billion in assets, which include $26.3 billion of assets under management, $49.1 billion in servicing and administration assets, and approximately $10.0 billion in proprietary assets, as of June 2024. Our parent company, ORIX Corporation, is a publicly owned international financial services company with operations in 30 countries and regions worldwide. ORIX Corporation is listed on the Tokyo Stock Exchange (8591) and New York Stock Exchange (IX).