With increasing urgency, investors are asking us, “Where do you think defaults and recoveries for middle-market loans are going?”

The short answer is that defaults are increasing, and recovery rates appear to be falling—a trend that should continue as long as the higher-for-longer interest-rate environment persists.

The more complete answer, though, is that increased defaults should prompt a rising volume of loan workouts.

In that case, we would ask investors two questions: “Are you willing to go through the workout process?” followed by “Is your middle-market lending manager equipped to handle workout situations to maximize recoveries?”

To fully explain our view, it is helpful to see today’s market conditions in the perspective of the recent past.

Our key takeaway is that expectations formed by previous conditions have left most investors unprepared for what we believe will happen.

Past As Prologue

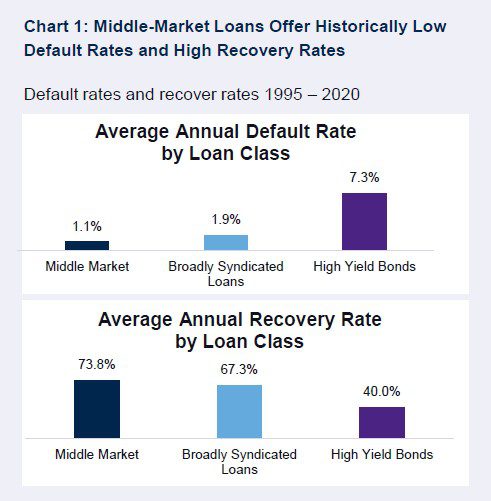

Investor interest in middle-market direct lending has soared in the last 10-15 years. In our view the catalyst for that was interest rates that were close to zero for much of the period, and topped out at about 2.4% in 2019, before the Federal Reserve’s aggressive pandemic-related easing in 2020. Middle-market loans have flourished because they offered a compelling combination of relatively high yields, a hedge against rising rates and inflation, strong credit quality and robust lender protections. Defaults were low at approximately 1%‒2% and recovery rates were high at 70%‒80%, (see Chart 1). There was a widespread—and reasonable—perception among investors that middle-market loans were a safe investment, akin to stashing cash in a mattress but with a higher return.

But as the saying goes, that was then and this is now. The fed funds rate currently is 5.25%‒5.50% and, we believe, likely to remain at fairly high levels throughout 2024 and possibly after that. Higher-for-longer poses a challenge for middle-market borrowers because it raises their debt-service costs and ratchets up the pressure on them to grow their revenues and cash flows.

Other factors signal turbulence ahead as well:

- General macro-economic pressures such as increases in labor costs, inflation, and a potential pull back in consumer spending.

- Many more loans to upper middle-market companies are structured as unitranches, which combines senior and junior debt risk, which likely will pressure recovery rates. Given the length of time since the last workout cycle in 2008-2009, and the increase in the number of Direct Lending managers, many managers do not have the experience and expertise in-house to navigate the complex workout process.

- The heightened competition for assets primarily in the upper middle market drove weakened credit terms, including loosening in or eliminating financial covenants and weaker EBITDA definitions. As a result, companies may see significant declines in Enterprise Value before lenders can exercise any rights and remedies typically afforded to them, limiting workout strategies.

The changed environment calls into question the assumptions about direct lending that prevailed for so long. In our view, the asset class remains attractive, but investors can expect defaults to increase—and workouts to rise accordingly. This is when a choice of managers becomes critical.

Ensuring You Have the Right Manager for Workouts

It’s crucial to have a direct lending manager that can meet today’s challenges. This applies not only to investors looking to initiate a position, but also to those with an existing allocation who may want to rethink their approach. In a market where many direct lenders offer workout capabilities it is helpful to understand the nuances that differentiate those who “offer” these capabilities and those who have these capabilities ingrained in their DNA as a firm. What to look for:

Scale and specificity. It’s common for large direct lending managers to have perhaps one senior-level professional with a strong workout background and a more junior-level person generalist looking at workouts. In this environment, and in our collective experience, having a robust and focused team who have worked through market cycles is essential.

NXT Capital has three dedicated senior workout professionals who have focused on workouts for the majority of their careers. As they like to say, “We want to be where the problem is.”

Experience. Considering that the last workout cycle happened 10‒15 years ago, it is fair to say that many workout professionals have not worked through a challenging market cycle — a disadvantage in the current environment.

The NXT Capital team’s three workout professionals have an aggregate of approximately 46 years of experience and focused on workouts during the last down cycle.

Expertise. Proficiency in navigating workouts requires expertise a mile wide and six inches deep, well beyond the basics of workout math. The NXT Capital team is steeped in the knowledge and practices of credit, cash flow and financial modeling, strategic alternative analysis, and legal remedies, as well as bankruptcy and reorganization law.

Knowing the right people. An important corollary to having experience and expertise is the importance of knowing other top advisors in the workout world.

These professionals—restructuring counsel, independent board members, financial advisors, investment bankers specializing in distressed situations—play key roles in the process and want to work with people they know and trust.

Our workout professionals are known and trusted members of this group, which can be highly advantageous to investors.

Comfort with the process. Even at its best, the workout process is extraordinarily difficult and intense. Workout professionals must be comfortable with numerous responsibilities and conflict resolution.

They must work with the company and sponsor to determine if the performance challenge is driven by macro or micro factors or mismanagement and determine the realistic path to performance improvement. In addition, they must be prepared for the workout process to last for months, if not years, until resolution.

The outcome could involve defaults, in which lenders end up owning the company. Workout professionals must negotiate with the understanding that the parties might not reach agreement, as well as have the willingness to take ownership of, and support, the defaulted company involved.

Many direct lending managers don’t want to become shareholders, which reduces their commitment to the workout process.

Walking the Talk

Our workout team has been through all the above situations, made the tough decisions, and represented our clients’ interests with patience, flexibility and resolve. Having the value-added workout expertise and capabilities sets us apart as a direct lending manager.

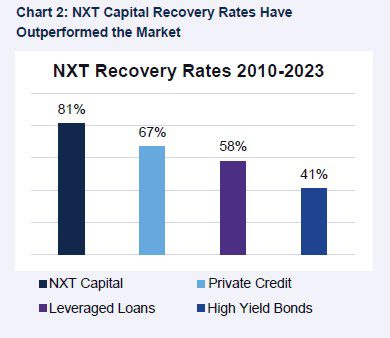

However, exceptional managerial characteristics are meaningless without results. Success in the workout world is measured by recovery rates—and ours have been superior.

Our team has worked together for a very long time and their track record goes back to 1995, even before NXT Capital was founded in 2010. This underscores not only the team’s long-term performance across a variety of market environments, but also its longevity as a cohesive unit.

Our recovery rate from defaulted loans is an aggregate 81% of all principal, fees and interest received after the default date (see Chart 2).

The corresponding recovery rates for overall private credit, leveraged loans, and high yield bonds in the same period were 67%, 48% and 41%, respectively.

In Summary

Given the interest rate environment and the other pressures faced by middle market companies, we do expect the direct lending market to continue to experience pressure on default rates and recovery rates.

As a result, we believe that credit discipline, appropriate structuring and workout expertise should be key criteria used by investors when selecting a manager.

Looking ahead, we believe our diligent focus on sourcing and underwriting high quality companies with top sponsors and prudent structures, coupled with our best-in-class workout team, can lead to NXT Capital continuing to outperform historical recovery rates, while continuing to provide best in class results, even in the choppy markets around the corner.

About NXT Capital

NXT Capital, based in Chicago with over 90 professionals, is a leading provider of senior structured financing solutions to the U.S. middle market. Since inception to 3/31/2024, the company has originated approximately $29.3 billion in total direct lending financing volume spread over 1,133 transactions.

NXT Capital also manages capital for third parties through its broad platform with multiple funds and separate accounts. Investment programs are managed by NXT Capital Investment Advisers, LLC, which is registered with the SEC as an investment adviser.

Registration with the SEC does not imply a certain level of skill or training. Loans will be arranged or made pursuant to a California Financing Law License. Lending/financing services provided by NXT Capital, LLC. Advisory services provided by NXT Capital Investment Advisers, LLC.

About ORIX Corporation USA

Established in the U.S. in 1981, ORIX USA has grown organically and through acquisition into the investment and asset management firm we are today.

With a specialization in private credit, real estate, and private equity solutions for middle-market focused borrowers and investors, we combine our robust balance sheet with funds from third-party investors, providing a strong alignment of interest. ORIX USA and its subsidiaries — ORIX Advisers, ORIX Capital Partners, Signal Peak Capital Management, Boston Financial, Lument, Real Estate Capital and NXT Capital — have approximately 1300 employees across the U.S. and have $85 billion in assets, which include $26.8 billion of assets under management, $48.6 billion in servicing and administration assets, and approximately $9.2 billion in proprietary assets, as of March 2024.

Our parent company, ORIX Corporation, is a publicly owned international financial services company with operations in 30 countries and regions worldwide. ORIX Corporation is listed on the Tokyo Stock Exchange (8591) and New York Stock Exchange (IX). For more information, visit orix.com.