Originally published by ORIX Group’s publication ORIX in Action

While everybody needs a home, even in advanced economies like the US, access to affordable housing is an ever-growing issue. In 2021, nearly half of Americans said access to affordable housing is a major problem where they live, according to Pew Research, an increase of 10% from 2018. More than 11 million people across the country spend over 30% of their net income just to make their rent.

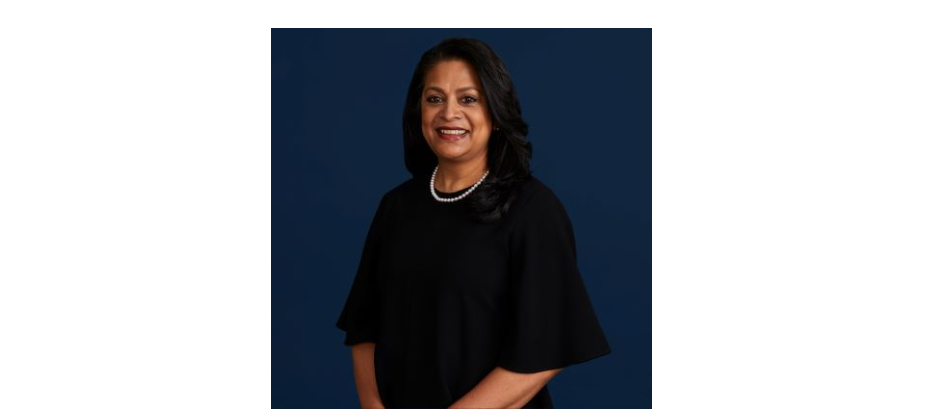

ORIX Corporation USA Group helps tackle this problem both through its businesses and through corporate philanthropy. “Across the board, we really pride ourselves on giving back to our communities,” says Rohini Pragasam, Managing Director and Head of Communications & Marketing at ORIX USA, who also chairs the internal advisory group overseeing all of ORIX USA’s corporate social responsibility (CSR) activities.

Over the past decade, ORIX USA has donated more than $20 million to non-profit organizations through employee-led philanthropy initiatives. Currently, the firm’s CSR Advisory Group continues the firm’s programmatic corporate giving with four areas of focus, including addressing affordable housing and homelessness. Ms. Pragasam stresses a dual strategy: not only providing the company’s money and the time of its employees through volunteerism; but also making a positive impact through certain business lines. “With the support of our Executive Sponsor, CEO Terry Suzuki, the CSR Advisory Group has been able to direct our giving to not only meet the increased needs in our communities, but also to align with our Diversity, Equity & Inclusion (DEI) goals and our areas of business focus in the US.”

The business of Boston Financial

The prime example of the latter is Boston Financial, an ORIX USA company since 2016. Boston Financial has been working for over 50 years to build and preserve low-income and affordable housing across America by raising investment funds with institutional investors and bringing that capital to support developers looking to preserve existing affordable communities or build new affordable housing projects.

As a syndicator, Boston Financial’s largest line of business is to acquire low-income housing tax credits from developers and distribute the credits and other tax benefits to investors. For the past three years, Boston Financial has been ranked as the top syndicator of low-income and affordable housing nationwide, with the industry’s largest portfolio of almost 170,000 rental units – spread across large and small developments, rural and urban ones, and some as far as the Virgin Islands and Guam.

The Launch of the LIHTC program

Boston Financial began in 1969 as a private partnership to help individuals invest in affordable, multi-family housing. In 1986, the US Congress created the Low-Income Housing Tax Credit (LIHTC) program. This allows investors to receive a credit against their federal taxes in exchange for investing in the building or rehabilitation of housing at rents that are affordable to low-income people.

After almost four decades, this program still enjoys bipartisan support and is generally regarded as one of the most successful programs to create affordable housing ever passed on Capitol Hill. Since the inception of the LIHTC program in 1986, Boston Financial has raised over $16 billion of equity for the construction or rehabilitation of more than 2,900 properties and has contributed to affordable housing production, job generation, and economic growth in urban and rural communities across the US.

It works like this: Every year, the federal government awards a pool of tax credits to each state. The states, in turn, allocate these to individual real estate developers which submit detailed applications for their projects and are scored on a number of metrics, with cost and projected rents being the key ones. If a developer’s application is approved, it is allocated a specific 10-year tax credit for the proposed project, while the community is restricted as ‘affordable’ for a minimum of 30 years.

Very often, however, the developer does not generate enough profit to be able to absorb all the tax credit itself and therefore seeks to sell the tax credits. This is where Boston Financial comes in, syndicating affordable housing projects into proprietary investment funds that combine multiple investors to bid for and buy such tax credits. These investors, mostly banks and insurance companies, tend to be larger and therefore able to make full use of the tax credits — as well as remaining in good standing with their respective regulators by investing in projects whose prime objective is increasing public welfare (see below).

Getting to Number One

In 1987, Boston Financial was the first firm to introduce a public tax credit fund on Wall Street and, in 1991, one of the first for-profit firms to offer an institutional tax credit fund. Steady growth ever since has elevated Boston Financial to its current market-leading position.

In 2020, the firm further expanded its total equity under management through the acquisition of a LIHTC portfolio of over $7 billion, invested in more than 1,200 properties. Currently, Boston Financial manages more than $16 billion of LIHTC equity invested in almost 2,000 properties.

Investing in the mission

The reason developers want to work with syndicators like Boston Financial is that they can raise funds by selling tax credits they cannot use. But what is the rationale for investors given the many competing assets on offer and rising yields elsewhere now that monetary policy is tightening? It comes down to two things: service levels and social mission.

In terms of social mission, under the 1977 US Community Reinvestment Act, banks and savings associations are required to extend a certain amount of credit to low- and moderate-income neighborhoods. In practice, they need to do so to remain in good standing with their regulators. Financing affordable housing qualifies, which is why commercial banks are the main investors in this market. Of course, they also get a very decent financial return, typically 5-7%, with the yield generally floating at a spread above US Treasuries.

Boston Financial prides itself on its service capabilities. Investors can either set up individual accounts with tailored investment objectives, often comprising just a few specific developments, or they can participate in a multi-investor fund. These multi-investor and proprietary investor funds typically range from $150 million to $350 million in size. Boston Financial aims to launch at least two multi-investor funds a year, in addition to proprietary LIHTC funds and impact investment funds, and has launched 27 funds since January of 2019.

All of this is underpinned by an eight-person Market Study group to evaluate the best projects, and a proprietary investment management technology program for investors. This has helped drive exceptional returns: over the past three decades, Boston Financial has syndicated over 60 multi-investor funds, of which 80% exceeded their yield objective, helping it retain 95% of its investors*. The fact that 80% of the developers it has worked with are now in their 15th year of doing business with the firm shows the client service culture extends throughout the organization.

* Prior results are no indication of future investment results.

Forward together: ORIX and Boston Financial

With its focus on a profitable, highly specialized financial niche, Boston Financial fits neatly into ORIX USA’s portfolio of innovative investment and asset management solutions. For the future, Boston Financial is hoping to target an annual syndication volume of $1.4 billion after surpassing $1 billion for the first time in 2021.

Boston Financial also wants to grow its involvement in the preservation of affordable housing, since many developments would benefit from new capital investment after the tax credits are distributed, the 15-year compliance period expires and the original investors exit. Preservation investing is a win-win for Boston Financial’s affordability focus and ORIX USA’s sustainable investing efforts because it keeps properties affordable to current tenants and provides for a lower environmental footprint than new development. Boston Financial—in collaboration with the ORIX USA Sustainability team—has put together a strategic framework to take traditional preservation investing a step further with a focus on the investment’s impact on residents’ lives. Boston Financial is taking an intentional approach to this, supporting communities that provide residents with social services and other initiatives, including the opportunity to build credit as renters.

Partnering with Habitat for Humanity

Meanwhile, ORIX USA is also addressing the critical issue of affordable housing through an ongoing hands-on partnership with Habitat for Humanity, a global non-profit housing organization.

Through this partnership, now extended to a second year, ORIX USA employees are participating in home building and repair projects across the US. In 2022, about 70 employee volunteers completed five ‘Build Day’ sessions in Boston, Columbus, Dallas, Irvine, and New York, working on a range of projects related to interior and exterior home building and repairs.

Habitat for Humanity’s Build Days bring volunteers together with professional volunteer builders to create affordable homes, often with the new future occupants working side by side to create their new home. Another six Build Days are in the books for 2023 with another 70 employees participating in projects through the summer.

Employees across the firm have been grateful for the opportunity to contribute. “Volunteering and giving back are a passion of mine,” says Jessica Lopez, Talent Acquisition Coordinator at ORIX USA. “This volunteer opportunity was special for me as it was in my childhood neighborhood of West Dallas.”

Helping to build a world where everyone has a decent place to live is a worthy goal and one that ORIX USA is proud to support in every way it can.