NXT Capital

Middle-Market Direct Lending and Investor Solutions

NXT Capital is a direct lender with a specialized focus on high-quality middle-market solutions.

Led by a senior team with 25+ years of experience sustaining middle market lending platforms through several business cycles, NXT Capital is a long-term partner offering flexibility in deal structure, certainty of close and straightforward communication.

NXT Capital is an established middle-market direct lender with over 95 experienced professionals. We serve borrowers who have complex, time-sensitive needs and require a customized, hassle-free solution from a reliable partner. We provide a full range of structured financing solutions through our Direct Lending Group.

Our platform provides a variety of programs for institutional investors to access proprietary floating rate middle-market loans sourced in the primary market. We believe investors also benefit from NXT Capital’s risk management processes and alignment with its balance sheet lending activities.

NXT Capital was founded in 2010 and is based in Chicago with offices in Atlanta, Dallas, and New York.

1,210Closed transactions since February 2010*

$10.7B Assets and Commitments**

129Backing from 126 banks and institutional investors***

Transactions

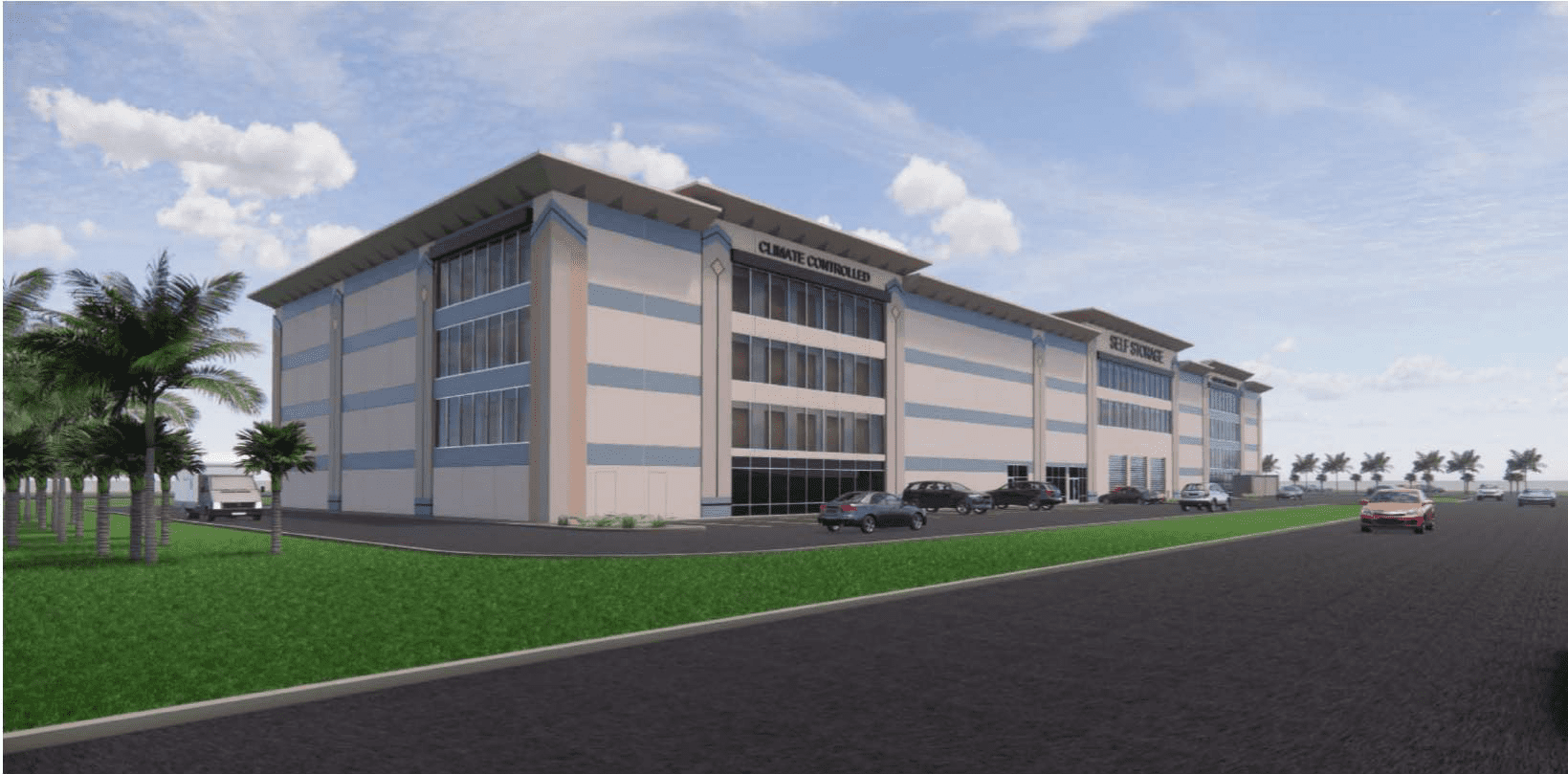

-

$47.76 Million

Bridge Loan

Self-Storage Portfolio

Southern U.S.

-

$26.25 Million

Construction Loan

Self-Storage

California

-

$45.8 Million

Construction Loan

Multifamily

Texas

-

$11 Million

Construction Loan

Self-Storage

Florida

-

$23 Million

Construction Loan

Industrial

New Jersey

-

$25.13 Million

Bridge Loan

Retail

Northeast

*2/2010 inception to 9/30/25. Excludes pre-acquisition ORIX Corporation USA portfolio, ORIX Corporation USA BSL portfolio, second lien commitments, and equity commitments.

** Numbers have been rounded and are unaudited. Represents capital currently invested, available capital not currently invested, which is either based on a contractual capital commitment for the program or our understanding of the program’s capital commitment expectation, and equity. Certain programs can unilaterally reduce or cancel their capital commitment, which would reduce the Assets shown above. Includes SMA, single investor programs, strategic partnerships ($6.2B), co-mingled funds ($2.0B), and invested capital or expected capital from parent, ORIX Corporation USA ($2.5B). SMAs, single investor programs, and co-mingled funds are clients of NXT Capital Investment Advisers, LLC. Strategic Partners are not advisory clients.

*** Total lenders to NXT Capital’s continuing businesses, investors in NXT Capital, investors in managed vehicles and unique lenders to managed vehicles.

All data as of September 30, 2025 unless otherwise noted.

NXT Capital, LLC is a wholly-owned subsidiary of ORIX Corporation USA. NXT Capital Investment Advisers, LLC (NXT Advisers) is an affiliate of NXT Capital, LLC. and is a US Securities and Exchange Commission (SEC) Registered Investment Adviser. Please note that such registration does not imply a certain level of skill or training or imply that the SEC has endorsed NXT Advisers’ qualifications to provide the advisory services provided by NXT Advisers described herein.

Lending/financing services provided by NXT Capital, LLC. Loans will be arranged or made pursuant to a California Financing Law License.