Signal Peak Capital Management

A syndicated loan asset management team

Signal Peak Capital Management (SPCM) is a syndicated loan asset management team of ORIX Advisers, LLC. SPCM manages approximately $4.9 billion in AUM primarily in broadly syndicated loans and structured credit investments across multiple CLO structures and separately managed accounts. The team has completed 31 CLO transactions since 2014.

SPCM has been led by co-heads David Martin and Erik Gunnerson for 15 years. The team’s 21 investment professionals average approximately 16 years of experience and includes 14 corporate credit analysts as well as trading and structured products professionals.

SPCM takes a conservative approach to portfolio management that seeks to achieve attractive returns through a balance of capital preservation and yield. The team identifies investments with strong credit quality, utilizing rigorous fundamental credit analysis as well as detailed capital structure and relative value modeling. Once invested, SPCM uses a multi-faceted investment surveillance process designed to identify issues and opportunities early.

~$4.9Bin AUM

31CLO transactions completed since 2014

SPCM was formerly the Leveraged Credit team at Mariner Investment Group, LLC. ORIX USA completed the sale of Mariner Investment Group, LLC in July 2020, retaining the Leveraged Credit Team, which was rebranded at ORIX USA as Signal Peak Capital Management.

Data as of September 30, 2025.

Transactions

-

$47.76 Million

Bridge Loan

Self-Storage Portfolio

Southern U.S.

-

$26.25 Million

Construction Loan

Self-Storage

California

-

$45.8 Million

Construction Loan

Multifamily

Texas

-

$11 Million

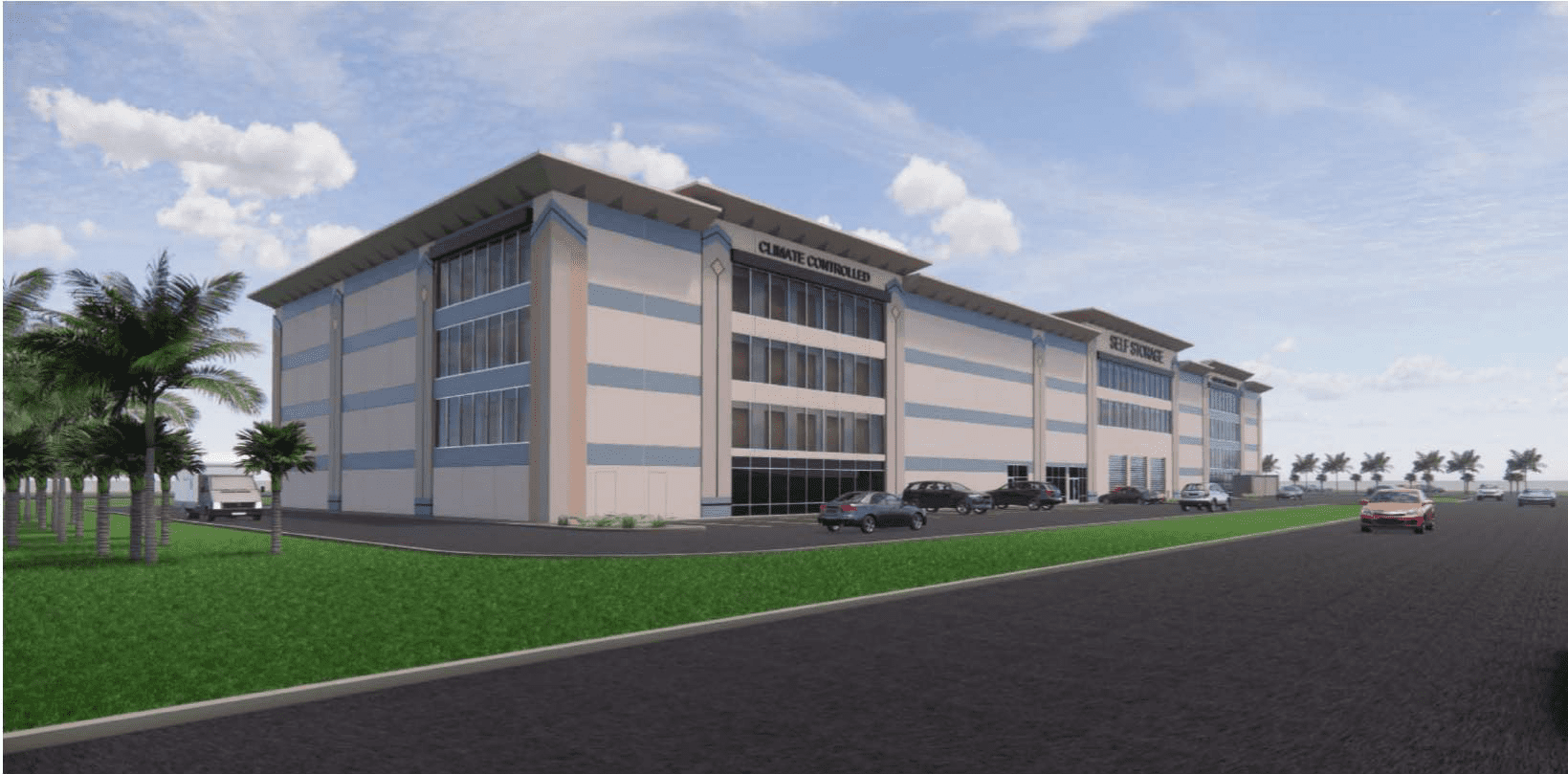

Construction Loan

Self-Storage

Florida

-

$23 Million

Construction Loan

Industrial

New Jersey

-

$25.13 Million

Bridge Loan

Retail

Northeast