Boston Financial

Purpose-driven for over 50 years

Experience matters. Boston Financial is a national leader in equity capital for tax-advantaged investments and the longest-standing Low Income Housing Tax Credit (LIHTC) syndicator in the country focused exclusively on affordable housing. We have built or preserved almost 400,000 affordable homes since 1969, investing in communities that give residents a place to live and a path to a better life.

Boston Financial’s growing platform is built on almost 60 years of investment opportunities in affordable housing at attractive yields. We have worked with more than 200 institutional investors to build and preserve affordable housing nationwide through low-income housing tax credit (LIHTC) funds and preservation equity impact investment funds. We work with national, regional, and community banks, insurance companies, and Fortune 500 companies, as well as pension funds, endowments, and family offices.

Since the inception of the LIHTC program in 1986, we have:

- Partnered with 1,200+ affordable housing developers

- Built and preserved 366,000+ affordable homes for 926,000+ people

- Syndicated more than $16 billion in equity to build and preserve affordable housing

- Sponsored over 200 tax credit funds

- Provided equity capital for affordable communities in all 50 states

For investors and affordable housing developers who need reliability, consistency, and expertise, Boston Financial offers a long-standing track record of exceptional service, optimal solutions, and positive outcomes for our partners and the communities we serve.

Our services

- Low-income housing tax credit (LIHTC) equity investments

- Working capital for affordable housing developers

- Equity and debt impact investments in affordable housing preservation

- Asset and portfolio management services

- Strategic investment opportunities

Our mission and values

Stable, decent housing plays a critical role in shaping lives. As a trusted partner, we foster investments that create a positive impact in U.S. communities as we stay true to our core values: integrity, collaboration, exceptional client service, and social responsibility.

We provide creative capital solutions for developers and give investors an opportunity to create social impact while achieving risk-adjusted returns. We believe everyone deserves a safe, quality, affordable place to live and, by working together, we believe we can make that a reality.

Transactions

-

$47.76 Million

Bridge Loan

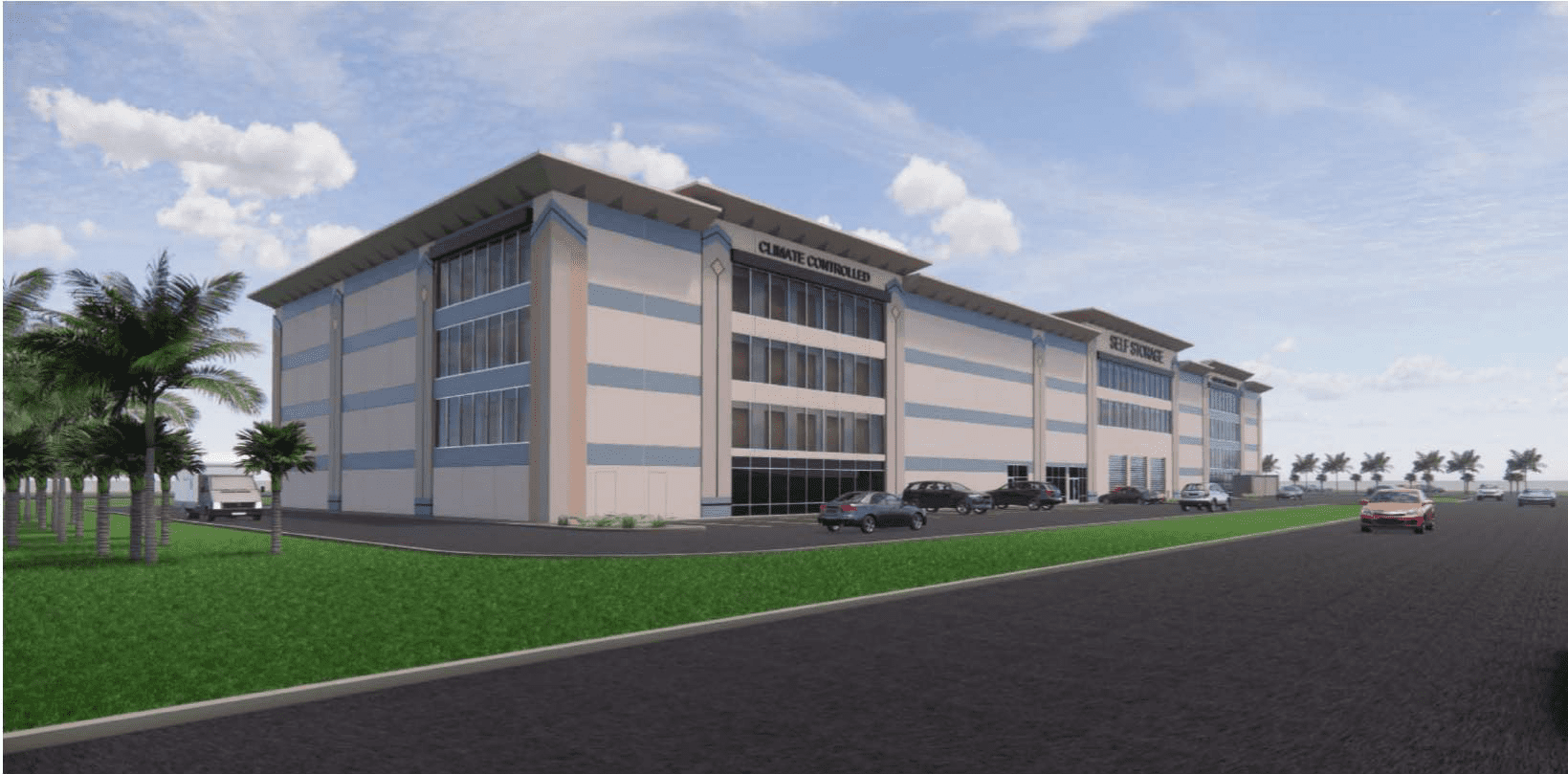

Self-Storage Portfolio

Southern U.S.

-

$26.25 Million

Construction Loan

Self-Storage

California

-

$45.8 Million

Construction Loan

Multifamily

Texas

-

$11 Million

Construction Loan

Self-Storage

Florida

-

$23 Million

Construction Loan

Industrial

New Jersey

-

$25.13 Million

Bridge Loan

Retail

Northeast